All Categories

Featured

Table of Contents

A level term life insurance policy plan can provide you satisfaction that the individuals that depend on you will have a survivor benefit during the years that you are intending to sustain them. It's a means to assist take care of them in the future, today. A degree term life insurance policy (occasionally called level costs term life insurance policy) policy provides insurance coverage for a set number of years (e.g., 10 or two decades) while maintaining the premium repayments the very same for the period of the policy.

With degree term insurance coverage, the cost of the insurance coverage will certainly stay the very same (or potentially reduce if dividends are paid) over the regard to your policy, usually 10 or twenty years. Unlike irreversible life insurance policy, which never ever expires as lengthy as you pay premiums, a degree term life insurance coverage policy will finish at some factor in the future, generally at the end of the period of your level term.

What is Short Term Life Insurance? A Guide for Families?

Because of this, lots of people utilize long-term insurance coverage as a secure monetary planning tool that can offer lots of requirements. You might have the ability to convert some, or all, of your term insurance during a collection duration, commonly the initial 10 years of your plan, without needing to re-qualify for insurance coverage even if your health has transformed.

As it does, you may desire to include to your insurance coverage in the future - Level term life insurance definition. As this takes place, you may want to ultimately lower your fatality benefit or think about transforming your term insurance policy to an irreversible plan.

So long as you pay your premiums, you can relax very easy recognizing that your loved ones will obtain a survivor benefit if you die during the term. Numerous term policies allow you the capacity to transform to permanent insurance coverage without needing to take another wellness examination. This can enable you to make use of the fringe benefits of an irreversible plan.

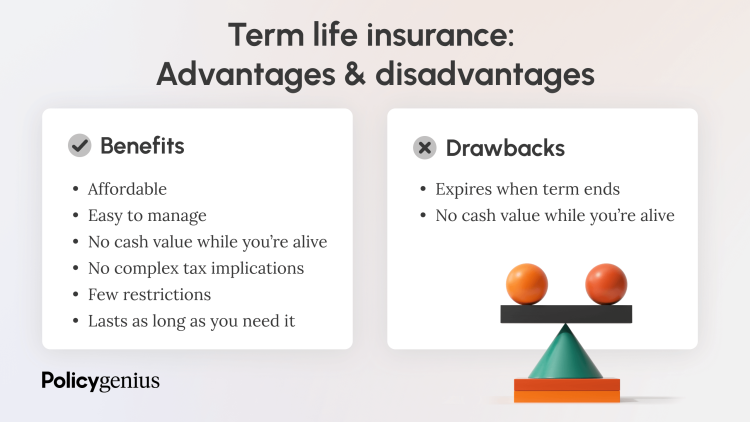

Degree term life insurance policy is among the easiest paths into life insurance coverage, we'll discuss the advantages and downsides so that you can choose a strategy to fit your requirements. Level term life insurance policy is the most common and standard kind of term life. When you're searching for short-term life insurance policy strategies, level term life insurance is one path that you can go.

The application process for level term life insurance policy is usually really simple. You'll fill out an application that includes basic individual information such as your name, age, etc in addition to a more in-depth set of questions about your case history. Relying on the policy you want, you might have to join a medical checkup procedure.

The short solution is no. A level term life insurance policy policy doesn't build money value. If you're seeking to have a policy that you have the ability to take out or borrow from, you may discover permanent life insurance policy. Whole life insurance coverage plans, for instance, let you have the convenience of fatality benefits and can accumulate cash worth with time, meaning you'll have much more control over your advantages while you live.

What Exactly is Level Benefit Term Life Insurance?

Riders are optional arrangements added to your plan that can offer you extra benefits and protections. Anything can occur over the program of your life insurance coverage term, and you desire to be prepared for anything.

There are instances where these benefits are built right into your policy, but they can likewise be readily available as a separate addition that requires extra repayment.

Latest Posts

Funeral Cover For Old Age

Life Insurance To Cover Final Expenses

Over 50 Funeral Insurance