All Categories

Featured

Table of Contents

Insurer will not pay a minor. Instead, take into consideration leaving the cash to an estate or count on. For more in-depth details on life insurance coverage obtain a copy of the NAIC Life Insurance Policy Buyers Guide.

The IRS positions a restriction on how much money can enter into life insurance policy costs for the policy and exactly how rapidly such premiums can be paid in order for the plan to retain all of its tax benefits. If certain limitations are exceeded, a MEC results. MEC policyholders might be subject to taxes on circulations on an income-first basis, that is, to the extent there is gain in their plans, in addition to fines on any type of taxed amount if they are not age 59 1/2 or older.

Please note that outstanding car loans accrue interest. Revenue tax-free therapy likewise presumes the finance will eventually be pleased from income tax-free death advantage profits. Loans and withdrawals lower the policy's cash money worth and survivor benefit, may trigger specific policy advantages or riders to come to be not available and may raise the chance the policy may lapse.

A client may qualify for the life insurance, however not the motorcyclist. A variable global life insurance policy contract is an agreement with the key purpose of giving a fatality benefit.

How do I cancel Estate Planning?

These portfolios are carefully handled in order to satisfy stated investment purposes. There are charges and charges related to variable life insurance policy agreements, including mortality and threat costs, a front-end load, administrative costs, financial investment monitoring fees, abandonment charges and charges for optional bikers. Equitable Financial and its affiliates do not provide legal or tax advice.

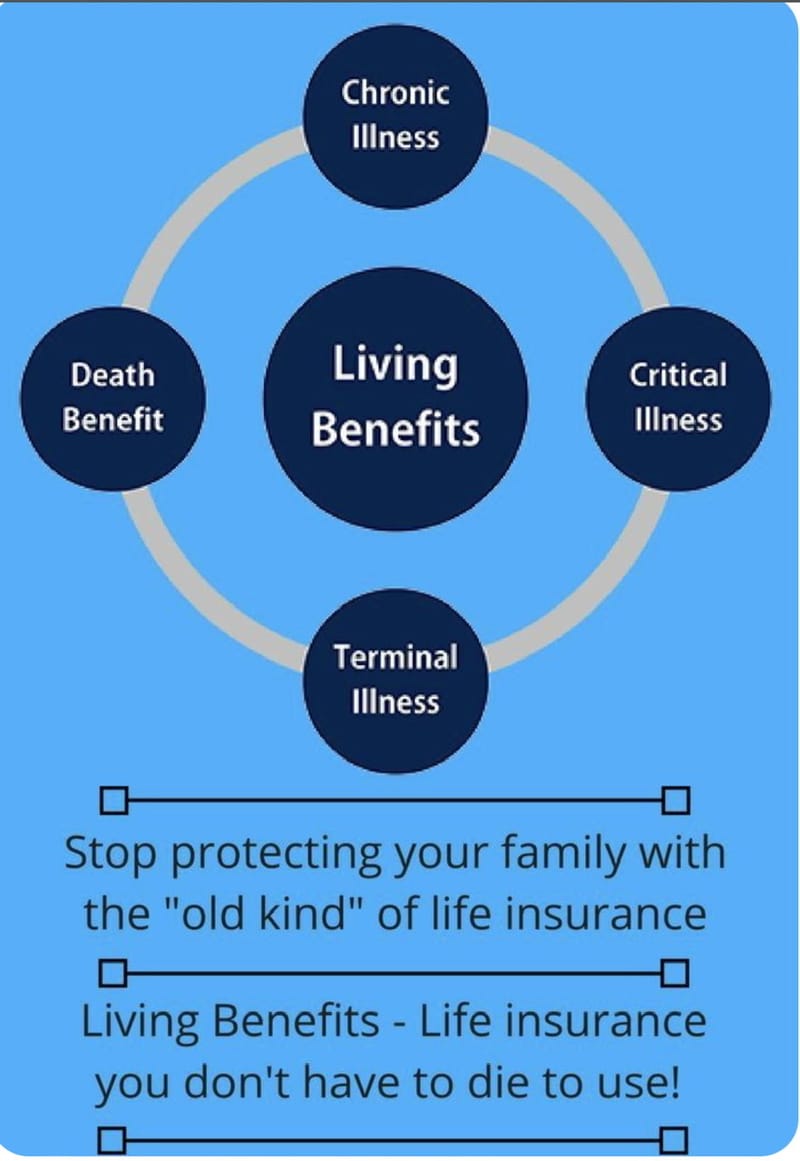

Whether you're beginning a household or getting married, individuals typically begin to consider life insurance coverage when somebody else begins to rely on their ability to earn a revenue. Which's fantastic, since that's exactly what the survivor benefit is for. But, as you discover more concerning life insurance, you're likely to locate that lots of policies for example, whole life insurance policy have extra than just a survivor benefit.

What are the advantages of entire life insurance coverage? One of the most appealing benefits of acquiring an entire life insurance policy is this: As long as you pay your premiums, your fatality benefit will never end.

Assume you do not need life insurance policy if you don't have kids? There are several advantages to having life insurance policy, also if you're not supporting a family members.

What is Wealth Transfer Plans?

Funeral expenditures, funeral prices and clinical costs can build up (Universal life insurance). The last point you want is for your loved ones to carry this extra burden. Long-term life insurance is available in various amounts, so you can select a survivor benefit that fulfills your needs. Alright, this only applies if you have children.

Determine whether term or long-term life insurance policy is appropriate for you. Get a quote of how much protection you might need, and exactly how much it can set you back. Locate the correct amount for your spending plan and tranquility of mind. Locate your quantity. As your personal scenarios change (i.e., marital relationship, birth of a youngster or task promotion), so will certainly your life insurance coverage needs.

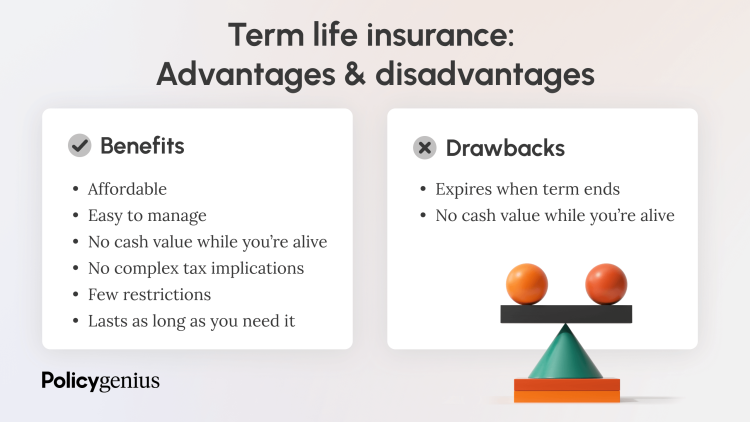

Essentially, there are two kinds of life insurance policy plans - either term or long-term plans or some mix of both. Life insurers provide various types of term plans and traditional life policies in addition to "passion delicate" items which have come to be a lot more prevalent since the 1980's.

Term insurance supplies protection for a given period of time. This duration can be as brief as one year or provide protection for a details variety of years such as 5, 10, two decades or to a defined age such as 80 or in some situations up to the earliest age in the life insurance policy mortality tables.

Who offers Flexible Premiums?

Presently term insurance coverage prices are extremely affordable and among the cheapest traditionally seasoned. It needs to be noted that it is a widely held belief that term insurance policy is the least pricey pure life insurance policy coverage readily available. One requires to review the plan terms very carefully to make a decision which term life alternatives appropriate to fulfill your specific conditions.

With each new term the premium is boosted. The right to renew the plan without evidence of insurability is a vital advantage to you. Otherwise, the risk you take is that your wellness may wear away and you might be not able to obtain a plan at the exact same rates or perhaps whatsoever, leaving you and your beneficiaries without insurance coverage.

The length of the conversion period will vary depending on the kind of term policy acquired. The costs price you pay on conversion is usually based on your "present achieved age", which is your age on the conversion date.

Under a degree term policy the face quantity of the plan remains the exact same for the whole duration. With decreasing term the face amount lowers over the period. The premium stays the same each year. Frequently such plans are offered as home loan protection with the quantity of insurance policy decreasing as the equilibrium of the mortgage decreases.

What are the top Riders providers in my area?

Commonly, insurance companies have not can transform costs after the plan is marketed. Considering that such policies may continue for several years, insurance providers must utilize traditional death, rate of interest and cost rate estimates in the costs estimation. Flexible costs insurance policy, nonetheless, enables insurance companies to offer insurance at lower "present" costs based upon less conventional assumptions with the right to transform these premiums in the future.

While term insurance policy is made to supply protection for a specified time period, irreversible insurance is designed to offer protection for your entire life time. To maintain the premium price degree, the costs at the more youthful ages exceeds the actual cost of protection. This extra costs develops a reserve (cash money value) which aids pay for the policy in later years as the price of security increases above the costs.

Under some policies, costs are needed to be spent for a set variety of years. Under various other plans, costs are paid throughout the insurance holder's life time. The insurance provider invests the excess costs dollars This kind of policy, which is occasionally called cash worth life insurance policy, creates a savings component. Cash money values are crucial to an irreversible life insurance policy policy.

Latest Posts

Funeral Cover For Old Age

Life Insurance To Cover Final Expenses

Over 50 Funeral Insurance