All Categories

Featured

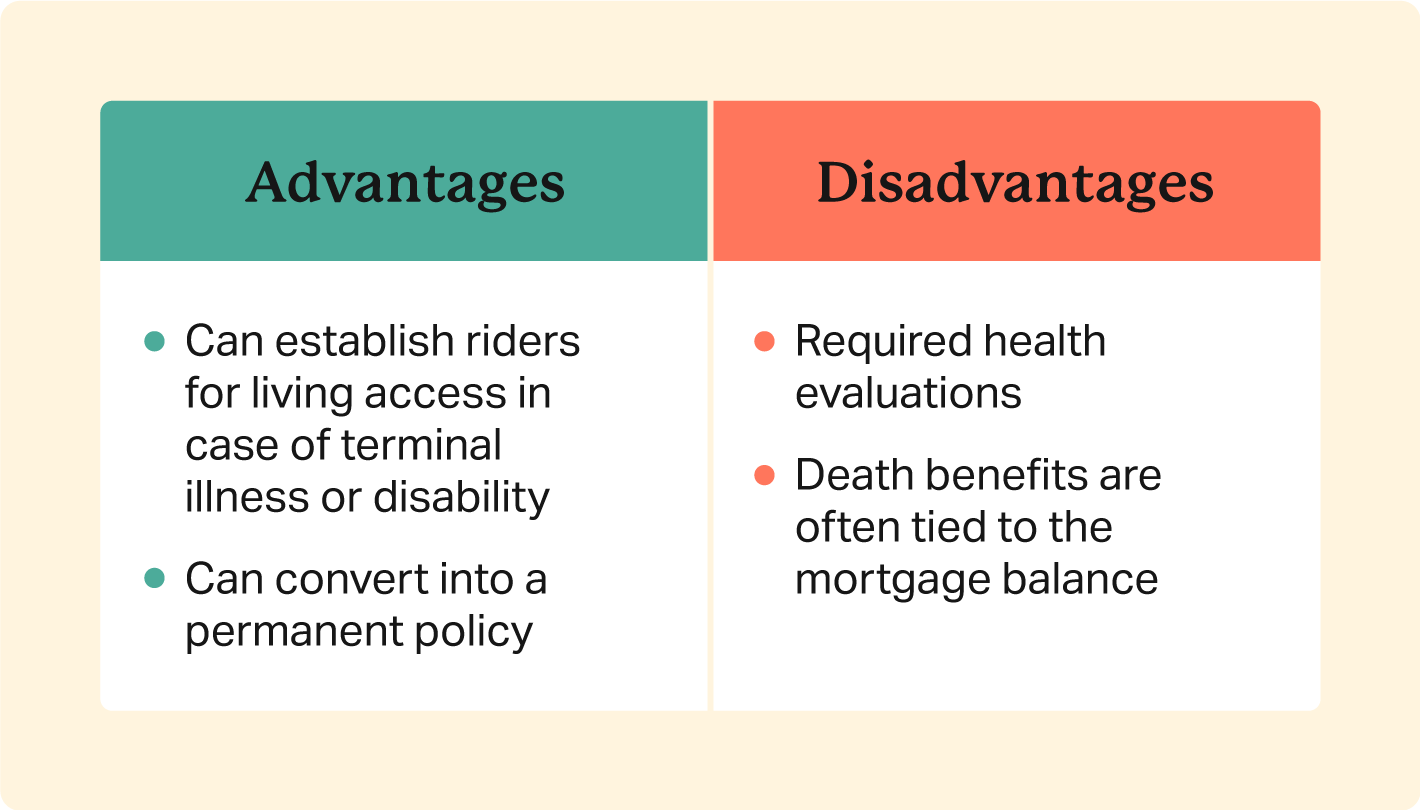

If you're healthy and balanced and have never ever used tobacco, you'll typically pay even more for home loan protection insurance coverage than you would for term life insurance policy (who sells mortgage insurance). Unlike other kinds of insurance coverage, it's tough to get a quote for mortgage security insurance coverage online - better mortgage insurance. Rates for mortgage security insurance can differ commonly; there is much less openness in this market and there are way too many variables to precisely contrast prices

Term life is an excellent alternative for mortgage security. Insurance holders can take advantage of a number of advantages: The amount of insurance coverage isn't restricted to your mortgage equilibrium. The fatality payout remains the very same for the term of the policy. The beneficiaries can make use of the policy continues for any purpose. The policy offers a fatality advantage even after the home loan is settled.

You may want your life insurance policy to secure even more than just your home mortgage. You select the plan worth, so your protection can be essentially than your home loan equilibrium. You might even have greater than one policy and "pile" them for tailored protection. By stacking policies, or bikers on your policy, you can reduce the life insurance policy benefit with time as your mortgage equilibrium reduces so you're not paying for insurance coverage you don't require.

If you're insured and die while your term life policy is still active, your picked loved one(s) can make use of the funds to pay the mortgage or for another function they choose. home mortgage insurance in case of death. There are lots of benefits to making use of term life insurance policy to secure your home mortgage. Still, it might not be an ideal option for everybody

Mortgage Protection Explained

Yes, due to the fact that life insurance policy plans have a tendency to align with the specifics of a home mortgage. If you buy a 250,000 home with a 25-year home mortgage, it makes feeling to acquire life insurance that covers you for this much, for this long.

Your family members or beneficiaries get their round figure and they can spend it as they like (life insurance on a loan). It is essential to recognize, nevertheless, that the Home mortgage Protection payment amount decreases in accordance with your mortgage term and balance, whereas level term life insurance policy will certainly pay the same round figure at any time throughout the policy size

Mortgage Replacement Insurance

On the other hand, you'll be alive so It's not like paying for Netflix. The amount you spend on life insurance every month does not pay back up until you're no longer below.

After you're gone, your enjoyed ones do not need to fret about missing settlements or being not able to pay for living in their home (mortgage protection insurance services inc). There are 2 primary selections of mortgage defense insurance, degree term and decreasing term. It's always best to obtain guidance to determine the policy that best speaks with your needs, budget plan and conditions

Latest Posts

Funeral Cover For Old Age

Life Insurance To Cover Final Expenses

Over 50 Funeral Insurance